Community Impact and Fall Mini Grants

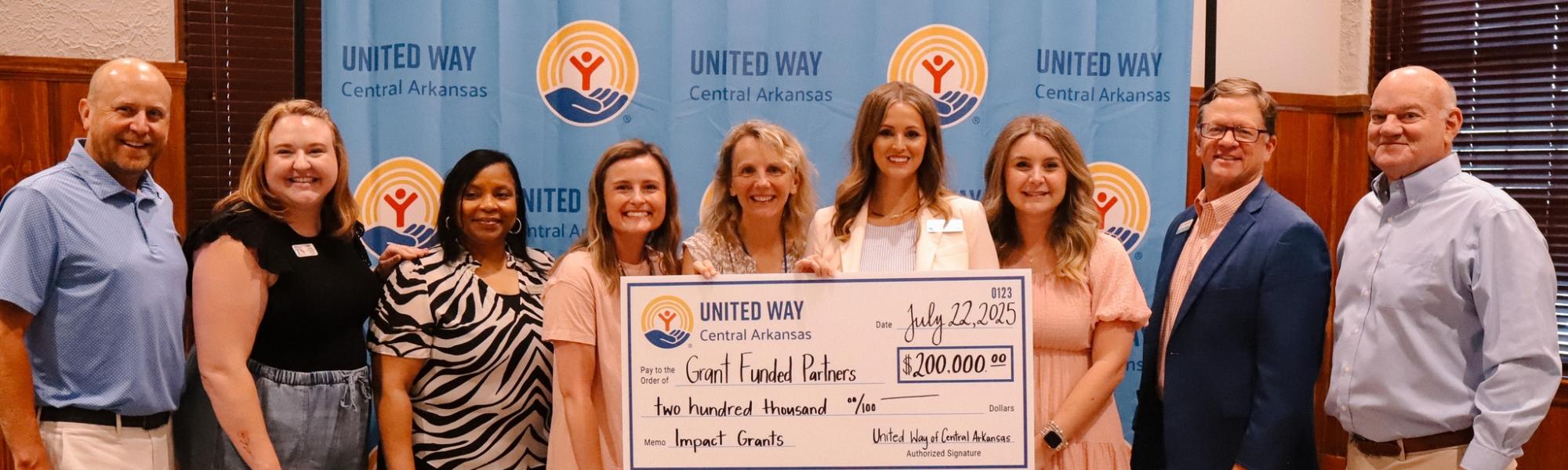

Over $250,000 were awarded to local non-profits in our community. These organizations make life-changing impacts within our community and we are so grateful to partner with them.

If you applied for our Community Impact Grant, we will announce recipients in June. In the meantime, if you have any questions, feel free to email e.laws@uwcark.org.

Grant Partners 2025

Bethlehem House serves homeless individuals and families with shelter, case management, transportation, recovery services, and food – everything they need. They work with our residents to get to the point of finding and maintaining work, paying off bills, and getting a fresh start on their lives. When ready to leave the program, they have the skills to maintain a responsible, healthy life. Through their Community Lunch Program and Resident To-Go Meal Service, individuals and families gain access to nutritious meals regularly, reducing food insecurity and ensuring they have reliable sources of nourishment.

This program fits our mission by making sure every child in Faulkner County will have access to club programs that provide the foundation for members to realize their full potential. On average during the school year, 150 youth are transported daily from 15 different schools. Most of the club kids would not be able to attend the Boys and Girls Club after-school program if we were unable to provide transportation through United Way grant funding.

This program fits our mission by making sure every child in Faulkner County will have access to club programs that provide the foundation for members to realize their full potential. On average during the school year, 150 youth are transported daily from 15 different schools. Most of the club kids would not be able to attend the Boys and Girls Club after-school program if we were unable to provide transportation through United Way grant funding.

The Children’s Advocacy Center brings together a team of trained professionals who evaluate and investigate child abuse as well as provide treatment services to child victims of abuse. By bringing all these services under one roof, we avoid re-traumatizing children who are already suffering. United Way funding allows CAC to expand community education and prevention services. This is important because we want to see a reduction in the number of child abuse cases and the way to accomplish that goal is through prevention and outreach services.

The Children’s Advocacy Center brings together a team of trained professionals who evaluate and investigate child abuse as well as provide treatment services to child victims of abuse. By bringing all these services under one roof, we avoid re-traumatizing children who are already suffering. United Way funding allows CAC to expand community education and prevention services. This is important because we want to see a reduction in the number of child abuse cases and the way to accomplish that goal is through prevention and outreach services.

CAPCA’s Emergency Shelter program works to address the immediate need for shelter for those experiencing homelessness and living in poverty. The emergency shelter allows clients a safe place to sleep, away from exposure to the elements, with access to a warm meal, shower, and bathroom facilities, while simultaneously allowing them access to our services and those of our community partners.

CAPCA’s Emergency Shelter program works to address the immediate need for shelter for those experiencing homelessness and living in poverty. The emergency shelter allows clients a safe place to sleep, away from exposure to the elements, with access to a warm meal, shower, and bathroom facilities, while simultaneously allowing them access to our services and those of our community partners.

Community Connections provides extra-curricular sports and arts programs for children with special needs. The programs are led by volunteer program directors and executed by volunteers in locations throughout the community, including UCA, Conway High School, local businesses (Sonshine Academy, Grand Master Hans, Larry's Pizza), and several area churches. Programs are typically offered once per week for 8-10 weeks (a couple of programs are offered once per month) in the fall, spring, and summer- providing healthy physical activity for kids with special needs and respite for their families.

Community Connections provides extra-curricular sports and arts programs for children with special needs. The programs are led by volunteer program directors and executed by volunteers in locations throughout the community, including UCA, Conway High School, local businesses (Sonshine Academy, Grand Master Hans, Larry's Pizza), and several area churches. Programs are typically offered once per week for 8-10 weeks (a couple of programs are offered once per month) in the fall, spring, and summer- providing healthy physical activity for kids with special needs and respite for their families.

Often youth with mental illness go untreated. This can lead to drug use, violence, and suicide. Their Youth Mental Health program partners youth age 18 and younger with certified mental health professionals at no cost to the family. United Way grant funding breaks down that burden for families that otherwise would leave many children without the critical health care they need. Funding provided through the United Way is used to leverage support from local and regional foundations.

Often youth with mental illness go untreated. This can lead to drug use, violence, and suicide. Their Youth Mental Health program partners youth age 18 and younger with certified mental health professionals at no cost to the family. United Way grant funding breaks down that burden for families that otherwise would leave many children without the critical health care they need. Funding provided through the United Way is used to leverage support from local and regional foundations.

The Conway Cradle Care (CCC) Early Childhood Education Program offers childcare and educational opportunities to children ages 6 weeks to 36 months of age whose adolescent parents are striving to complete their high school education, seek higher education, pursue job readiness skills training, or gain and retain employment. The Adolescent Parent Program strives to combat the negative effects of adolescent parenthood for both parent and child while practicing a strengths-based approach to encouraging educational advancement and positive life choices.

The goal of the Refuge Family and Respite Care shelter is to meet a critical need in our community. They will provide emergency housing for families with children and people with medical needs/disabilities who are experiencing homelessness. CMC will provide intensive case management services to our residents to transition them into the most appropriate housing for their unique needs. The Refuge will have 22 housing units available for emergency shelter. Residents may stay in the shelter for up to 90 days while they engage in case management that will transition them to the most appropriate next step.

The Interfaith Dental Clinic is partnering with Conway Public Schools to create the Smile Savers Program. This program will offer free dental services such as cleanings, extractions, and partials to students of low-income families. By partnering with the school system, they aim to streamline the process of identifying and addressing dental needs among students. This initiative not only enhances oral health but also contributes to improved academic outcomes and overall community well-being.

The Interfaith Dental Clinic is partnering with Conway Public Schools to create the Smile Savers Program. This program will offer free dental services such as cleanings, extractions, and partials to students of low-income families. By partnering with the school system, they aim to streamline the process of identifying and addressing dental needs among students. This initiative not only enhances oral health but also contributes to improved academic outcomes and overall community well-being.

Congregate Meals - Serve hot, nutritionally balanced meals each weekday at our six senior centers located in Faulkner County. Grant funding from the United Way is matched with federal grant funds and provides for nearly a quarter of the meals that will be served to senior citizens in Faulkner County this year.

Congregate Meals - Serve hot, nutritionally balanced meals each weekday at our six senior centers located in Faulkner County. Grant funding from the United Way is matched with federal grant funds and provides for nearly a quarter of the meals that will be served to senior citizens in Faulkner County this year.

Health & Wellness - All activities, including access to our fitness center and Certified Personal Trainer, are provided at no cost to our seniors. Grant funding from the United Way is matched with federal grant funds and provides for nearly a third of all activities benefitting senior citizens in Faulkner County.

Home Delivered Meals- provide nutrition and daily social contact to the frailest of the senior population – those who are homebound.

Habor Home's program is a faith-based home for women coming out of the darkness of addiction. There are two phases to the program. They do not charge their residents, and help women from all across the United States. They provide counseling, parenting classes, financial classes, and more. United Way of Central Arkansas helps fund the Phase 2, where residents attend classes and create a plan to pay fines, create savings accounts, and even enroll in the PACE program at CBC with the help of Harbor Home staff.

MHRC delivers nutritious meals to seniors at age 60 or older in Conway and Perry counties. They have five routes for delivered meals in each county, and additionally offer in-house meals and curbside pickup. They currently serve 650 clients throughout Conway and Perry counties. United Way grant funding is critical for allowing us to serve all seniors with need and not have a wait list that creates food insecurity for our senior population.

MHRC delivers nutritious meals to seniors at age 60 or older in Conway and Perry counties. They have five routes for delivered meals in each county, and additionally offer in-house meals and curbside pickup. They currently serve 650 clients throughout Conway and Perry counties. United Way grant funding is critical for allowing us to serve all seniors with need and not have a wait list that creates food insecurity for our senior population.

All of Milestones' energy and focus goes toward helping children with developmental delays achieve their maximum potential. Services provided through this program include day habilitation under the supervision of certified teachers; inclusion with children who are typically developing; therapies as needed and prescribed by a child's primary care physician; nursing services as required for children to attend; and adequate nutrition and transportation. Milestones is rated as a 3-star Better Beginnings child-care facility. A portion of United Way grant funding is multiplied 9 to 1 with federal funds.

All of Milestones' energy and focus goes toward helping children with developmental delays achieve their maximum potential. Services provided through this program include day habilitation under the supervision of certified teachers; inclusion with children who are typically developing; therapies as needed and prescribed by a child's primary care physician; nursing services as required for children to attend; and adequate nutrition and transportation. Milestones is rated as a 3-star Better Beginnings child-care facility. A portion of United Way grant funding is multiplied 9 to 1 with federal funds.

Through the holistic approach to health and wellness, Rise House ais working to end the generational cycle of abuse. Survivors of domestic abuse who enter Rise House are not only provided with shelter, food, and necessities, but also support groups, life skills classes, and therapy. Grant funding from the United Way is allowing Rise House to take programs that were already offered on a small scale and expand them to reach even more clients.

Through the holistic approach to health and wellness, Rise House ais working to end the generational cycle of abuse. Survivors of domestic abuse who enter Rise House are not only provided with shelter, food, and necessities, but also support groups, life skills classes, and therapy. Grant funding from the United Way is allowing Rise House to take programs that were already offered on a small scale and expand them to reach even more clients.

VBCAP Home Delivered Meals Program provides nutritious meals to homebound senior neighbors. Meals are approved by a registered dietician are delivered to those in remote areas of our rural county. A friendly visit and safety check comes with each meal delivery.